Revenue cycle management (RCM) is straightforward. See a patient, submit a claim, and collect payment. Nowadays, it has become a complex act involving prior authorizations, denial management, patient responsibility, regulatory compliance, value-based care metrics, and technology integration. The global revenue cycle management market was measured at USD 85.2 billion in 2025. For the years to come, it has been forecasted to grow with a CAGR of 11.53% between 2026 and 2034.

The healthcare revenue cycle management trends emerging this year are all about working smarter than ever. According to the results from the MGMA poll, 37% of medical group leaders said that their biggest new investment in 2026 budgets will be in the workforce. For that, practices must adapt to these revenue cycle management industry trends in order to succeed.

The RCM trends are crucial for the understanding of small independent practices and multi-location organizations. This blog showcases the most important trends in revenue cycle management for 2026. Leveraging them is better for the financial performance of the practice. Let’s explore what’s changing, why it matters, and how your practice can stay ahead.

The State of Healthcare Revenue Cycle Management in 2026

Let us look into the current landscape of revenue cycle management trends. Healthcare organizations are facing unprecedented challenges. Some of these challenges have been listed below-

Prior authorization requirements have increased by 30% in the last three years

Claim denial rates have been around 10-15% industry-wide, with some specialties seeing even higher rates

Patient responsibility has grown significantly due to high-deductible health plans

Staffing shortages make it difficult to maintain experienced billing teams

Regulatory complexity continues to expand with new compliance requirements

At the same time, healthcare providers are expected to maintain profitability while delivering excellent patient care. This is why revenue cycle management industry trends of 2026 focus heavily on automation, outsourcing, and proactive financial strategies. The practices winning in this environment are implementing the latest healthcare revenue cycle management trends to fundamentally transform their billing and collections.

Understand the key differences between medical billing and revenue cycle management

Top Revenue Cycle Management Trends for 2026

Healthcare revenue cycle management is evolving rapidly in 2026 as practices face higher denials, tighter payer rules, staffing gaps, and growing patient financial responsibility. Success now depends on a hybrid approach combining data-driven insights with experienced RCM professionals to prevent revenue loss before it starts. From AI-assisted denial prevention and proactive patient engagement to outsourced RCM, efficient prior authorizations, and stronger system integration, the trends below highlight what healthcare organizations must focus on to protect cash flow, improve efficiency, and stay financially resilient.

1. AI and Automation for Denial Prevention

Artificial intelligence is giving a new skin to how practices handle claim denials. However, AI alone isn’t the answer. The most effective approach combines AI technology with experienced billing professionals.

What’s changing:

AI tools can only predict which claims are likely to be denied before submitting

Machine learning algorithms can identify denial patterns across payers and procedure codes

Automated claim scrubbing can catch errors to rejections

Predictive metrics help practices address the root causes of denials

Why it matters:

Denials cost practices a lot of time and money. The average denial cost is $25 for rework, and 60% of denied claims are never resubmitted. While AI can flag potential issues, experienced RCM professionals are needed to interpret complex denial reasons, craft effective appeals, and implement systemic fixes. This is why the hybrid model of AI + human expertise is becoming the standard in healthcare revenue cycle management trends.

2. Proactive Patient Financial Engagement

Patient responsibility has increased with a rise in high-deductible health plans. In 2026, successful practices are shifting from reactive collections to proactive financial engagement.

What’s changing:

Cost estimate before the procedures

Digital payment options and payment plans

Text and email payment reminders

Transparent billing practices that build trust

Why it matters:

Patients are responsible for increasing the amount of total healthcare costs in many scenarios. Practices that wait until after services to discuss costs face lower collection rates and patient dissatisfaction. Proactive engagement is one of the critical trends in revenue cycle management because it improves both collections and the experience of the patients. Practices implementing upfront financial engagement see 20-30% improvement in patient payment collection rates and fewer bad debt write-offs.

3. Value-Based Care and Alternative Payment Models

The shift from fee-for-service to value-based care continues to accelerate, creating new revenue cycle management industry trends around quality metrics and bundled payments.

What’s changing:

Payment tied to patient outcomes than volume of services

Bundled payments for episodes of care

Risk-sharing arrangements with payers

Quality metrics affecting reimbursement rates

Need to track clinical and financial data together

Why it matters:

Practices must monitor patient outcomes, quality measures, and population health metrics alongside traditional billing. This is transforming healthcare revenue cycle management trends toward more integrated systems. Many practices are managing both fee-for-service and value-based contracts simultaneously, requiring billing teams that understand both models and can navigate the complexity.

Learn why outsourcing RCM is the smart move for practices managing complex payment models

4. Outsourced RCM Solutions and Virtual Staffing

Staffing challenges are driving one of the fastest-growing trends in revenue cycle management. Outsourcing to a specialized RCM provider and virtual staffing solution can have a significant impact on the healthcare organization.

What’s changing:

Dedicated remote billing specialists working for specific practices

End-to-end outsourced revenue cycle management

Virtual medical assistants handling prior authorizations and eligibility checks

Access to specialized expertise without geographic limitations

Cost savings of 30-40% compared to in-house billing departments

Why it matters:

The healthcare staffing crisis makes it nearly impossible for many practices to maintain experienced billing teams. Turnover is expensive, and training takes months. Outsourcing has become a strategic solution, not a last resort.

DrCatalyst’s approach:

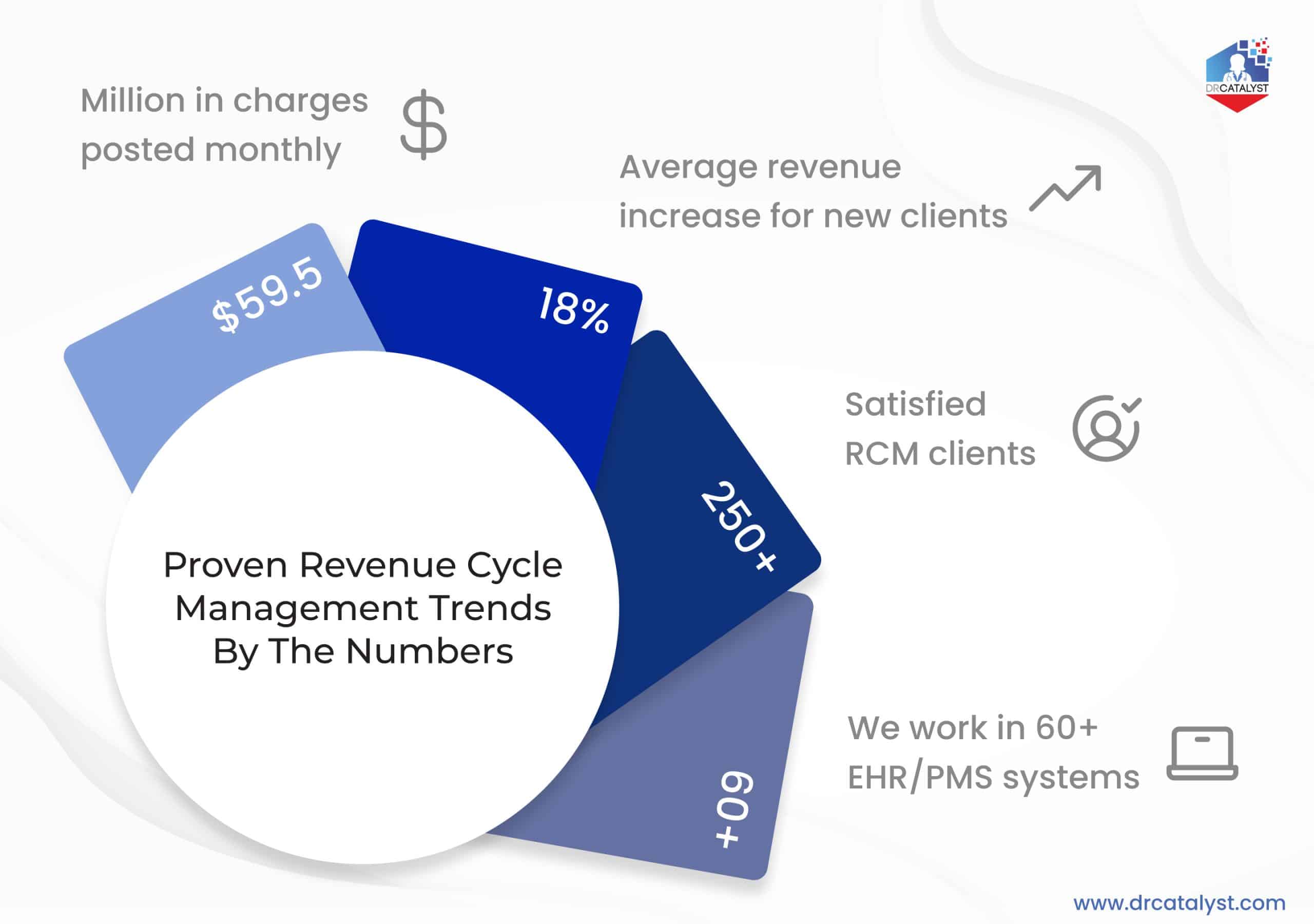

At DrCatalyst, we’ve processed $59.5 million in charges monthly and delivered an average 18% revenue increase for new RCM clients. Our model combines US-based account managers with offshore billing teams, certified coders, and multiple levels of quality assurance. This gives practices enterprise-level RCM expertise at a fraction of the cost.

5. Enhanced Data Analytics and Reporting

Data-driven decision making is no longer optional. Healthcare revenue cycle management trends in 2026 emphasize detailed analytics and actionable reporting.

What’s changing:

Real-time dashboards showing key performance indicators

Predictive analytics for cash flow forecasting

Payer performance tracking and contract analysis

Provider productivity and coding accuracy metrics

Denial trend analysis by payer, procedure, and denial reason

Why it matters:

You can’t improve what you don’t measure. Detailed analytics help practices identify exactly where revenue is being lost and what actions will have the biggest impact. This is one of the most powerful revenue cycle management industry trends because it turns it from a reactive process into a strategic function.

Key metrics to track:

Days in accounts receivable

Clean claim rate

Denial rate by payer and reason

Collection rate

Cost to collect

Net collection rate

6. Restructuring Prior Authorization

Prior authorizations have become one of the biggest bottlenecks in healthcare, and revenue cycle management trends are addressing this challenge head-on.

What’s changing:

Electronic prior authorization (ePA) systems

AI-assisted authorization submissions

Dedicated prior authorization teams (virtual or in-house or both)

Proactive authorization tracking before appointments

Integration between EHR and payer portals

Why it matters:

The average practice spends 16 hours per week on prior authorizations. Delays in approvals mean delays in treatment and revenue. Streamlining prior authorizations is critical for both patient care and financial health.

DrCatalyst’s solution:

Our virtual medical assistants handle 40,000+ prior authorization tasks monthly across specialties. We track submissions, follow up with payers, handle appeals, and communicate approvals to your clinical team so treatments aren’t delayed and revenue flows smoothly.

Explore DrCatalyst’s virtual healthcare staffing solutions

7. Cybersecurity and HIPAA Compliance

With increased digitization comes increased risk. Cybersecurity is one of the most critical healthcare revenue cycle management trends for protecting patient data and practice finances.

What’s changing:

Multi-factor authentication becoming standard

Advanced encryption for data transmission

Regular security audits and penetration testing

Staff training on phishing and social engineering

Third-party HIPAA compliance certification

Why it matters:

A single data breach can cost practices millions in fines, legal fees, and reputational damage. With RCM systems handling sensitive financial and clinical data, security must be built into every process.

DrCatalyst’s commitment:

We take cybersecurity seriously with CrowdStrike next-generation antivirus, Google Workspace Enterprise for email security, ActivTrak staff monitoring, and third-party HIPAA compliance certification through Compliancy Group. Your data security is non-negotiable for us!

8. Integration between Clinical and Financial Systems

Siloed systems are a thing of the past. One of the emerging revenue cycle management industry trends is swift integration between EHRs, practice management systems, and billing platforms.

What’s changing:

Single sign-on across systems

Automatic data synchronization between clinical and billing platforms

Instant processing on patient insurance and authorization status

Integrated documentation that supports coding and billing

Unified reporting across clinical quality and financial metrics

Why it matters:

When clinical and financial systems don’t communicate, errors multiply, staff waste time on duplicate data entry, and claims get delayed. Integration leads to uniform workflows and ensures accuracy throughout the revenue cycle.

9. Focus on Staff Training and Education

Even with automation and AI, people remain at the heart of revenue cycle management. Continuous training is one of the most overlooked but essential trends in revenue cycle management.

What’s changing:

Regular coding updates and payer policy training

Cross-training staff on multiple RCM functions

Ongoing education on denial management strategies

Training on new technologies and EHR updates

Certification programs for billing specialists

Why it matters:

Healthcare regulations, coding guidelines, and payer policies change constantly. Without ongoing training, billing teams fall behind, errors increase, and revenue suffers. Investing in staff education is investing in your practice’s financial health.

10. Automation of Front-end Processes

One of the most significant revenue cycle management trends is the automation of front-end processes, such as the activities that happen before claims are even submitted.

What’s changing:

Quick insurance eligibility verification

Automated benefits checks

Digital patient intake and registration

Automated prior authorization submissions

Electronic consent forms and documentation

Why it matters:

Front-end errors are the leading cause of claim denials. Automating these processes reduces mistakes, speeds up patient registration, and ensures cleaner claims from the start. This RCM trend directly impacts cash flow by preventing denials before they happen. Practices implementing front-end automation see a reduction in registration errors and fewer claim denials related to eligibility and benefits issues.

However, automating front-end processes must be done with a pinch of salt. While the automating tools benefit with free time, they do not assure of data leaks, duplication, cyberattacks, and everything that can potentially breach the HIPAA policy. With a professional RCM specialist combined with the inputs from an automating tool is the way to go for modernizing RCM.

Discover DrCatalyst’s comprehensive revenue cycle management services

How DrCatalyst helps you align with the Revenue Cycle Management Trends

At DrCatalyst, we keep up with healthcare revenue cycle management trends and implement them for practices across 60+ specialties and 44 states. Our comprehensive RCM sets us apart in the following ways-

Charge entry and initial coding review

Claims scrubbing and submission

Insurance and patient payment posting

Denial management and appeals

Accounts receivable management

Patient statement generation and follow-up in English and Spanish

Regular reporting and KPI tracking

Results we can bank on:

$59.5 million in charges posted monthly

18% average revenue increase for new clients

250+ satisfied RCM clients

We work in 60+ EHR/PMS systems

Transparent Pricing:

Our RCM services are priced at a percentage of your total monthly receipts based on your billing data. No hidden fees, no surprises, just results-driven revenue cycle management.

Virtual Staffing for Specialized RCM Tasks

If you would like to start small, then scale up, we offer virtual staffing solutions for specific revenue cycle functions:

Virtual Medical Billers

They’re skilled at-

Accounts receivable work

Insurance eligibility and benefits verification

Denial management

Regular billing tasks

Requires your practice to provide billing supervision

Virtual Medical Coders

They’re AAPC-certified CRCs and CPCs and do-

CPT/HCPCS/HCC/ICD-10 coding

Coding and documentation audits

Review coding errors with providers

Credentialing Services

They’re skilled at-

Individual and group provider credentialing

New provider enrollment with payers

CAQH updates and maintenance

Re-credentialing management

Virtual Medical Assistants (bilingual Spanish/English):

They’re skilled at

Prior authorizations (40,000+ monthly tasks)

Eligibility and benefits verification

Referral processing (20,000+ monthly tasks)

Phone reception (208,000+ monthly calls)

Medical records management

Why Practices prefer DrCatalyst

90-day “try us out” period for staffing agreements

3+ levels of supervision included

Written protocols (SOPs) developed specifically for your practice

Daily productivity reports for complete transparency

24/7 cybersecurity operations with enterprise-level protection

HIPAA BAA included with a US-based company

Third-party HIPAA compliance certification

Continuous staff training on the latest RCM best practices

Preparing your Practice for Future RCM Trends

The revenue cycle management industry trends we’re seeing in 2026 are just the beginning. From AI-powered denial management to value-based care models, from patient financial engagement to cybersecurity concerns, practices must adapt or risk falling behind. The trends in revenue cycle management with the right partner can position your practice on the right path to monetary benefits: